Short Summary

So, Can You Really Divorce Without Splitting Assets?

The short answer is Yes, it is possible to divorce without splitting assets. This can happen through a prenuptial agreement, a mutual agreement, or your specific state laws. However, in community property states, such as California, any income, real estate, or other property acquired by either spouse during the marriage belongs to both spouses, and these assets are typically split equally in the event of a divorce. Anything acquired by the parties before the marriage remains individual property and is not included in a divorce settlement. On the other hand, in equitable distribution states, such as Colorado, assets acquired during the marriage are divided fairly but not necessarily equally.

Here are some general scenarios where you can divorce without splitting assets in 2024:

- Prenuptial Agreement: If the couple signed a prenuptial agreement that outlines how assets should be handled in the event of a divorce, and this agreement stipulates that certain assets will not be split, this arrangement will usually be honored, provided the agreement was made legally and fairly.

- Separate Property: In some jurisdictions, property that was owned by one spouse before the marriage, or gifts and inheritances received by one spouse during the marriage, are considered separate property and not subject to division upon divorce. However, the distinction between separate and marital property can be complex, and in some cases, separate property can become marital property, for instance, if it’s commingled with marital assets.

- Mutual Agreement: The couple may mutually agree not to split certain assets. This agreement should be documented in a legal settlement and approved by a court to ensure it’s enforceable.

- Short Duration Marriages: In cases of very short marriages, courts might decide that each party should simply retain their own assets, particularly if the marriage did not significantly alter the financial situation of either party.

- Jurisdiction-Specific Laws: The laws governing asset division vary greatly from place to place. Some jurisdictions have more stringent rules about dividing assets, while others may allow more flexibility.

It’s important to note that even in cases where assets are not split, issues such as spousal support or child support may still need to be addressed. Also, it’s crucial to seek legal advice in your specific jurisdiction to understand how the laws apply to your particular situation.

Introduction

Divorce is rarely a straightforward process, especially when it comes to the division of assets. But can you divorce without splitting assets? While it may sound like a pipe dream, there are situations where couples can avoid dividing their assets during a divorce. In this blog post, we will explore the concept of status-only divorce, the importance of prenuptial and postnuptial agreements, alternative strategies for asset division, and potential risks and challenges to consider.

- Understanding asset division in divorce is complex and varies between community property states and equitable distribution states.

- Status-only divorces are legal dissolutions of marriage that do not address assets or liabilities, but can have implications for both parties.

- Prenuptial/postnuptial agreements, mediation & collaborative divorce, creative solutions to asset division & professional guidance can help avoid potential risks associated with attempting to divide assets during a divorce.

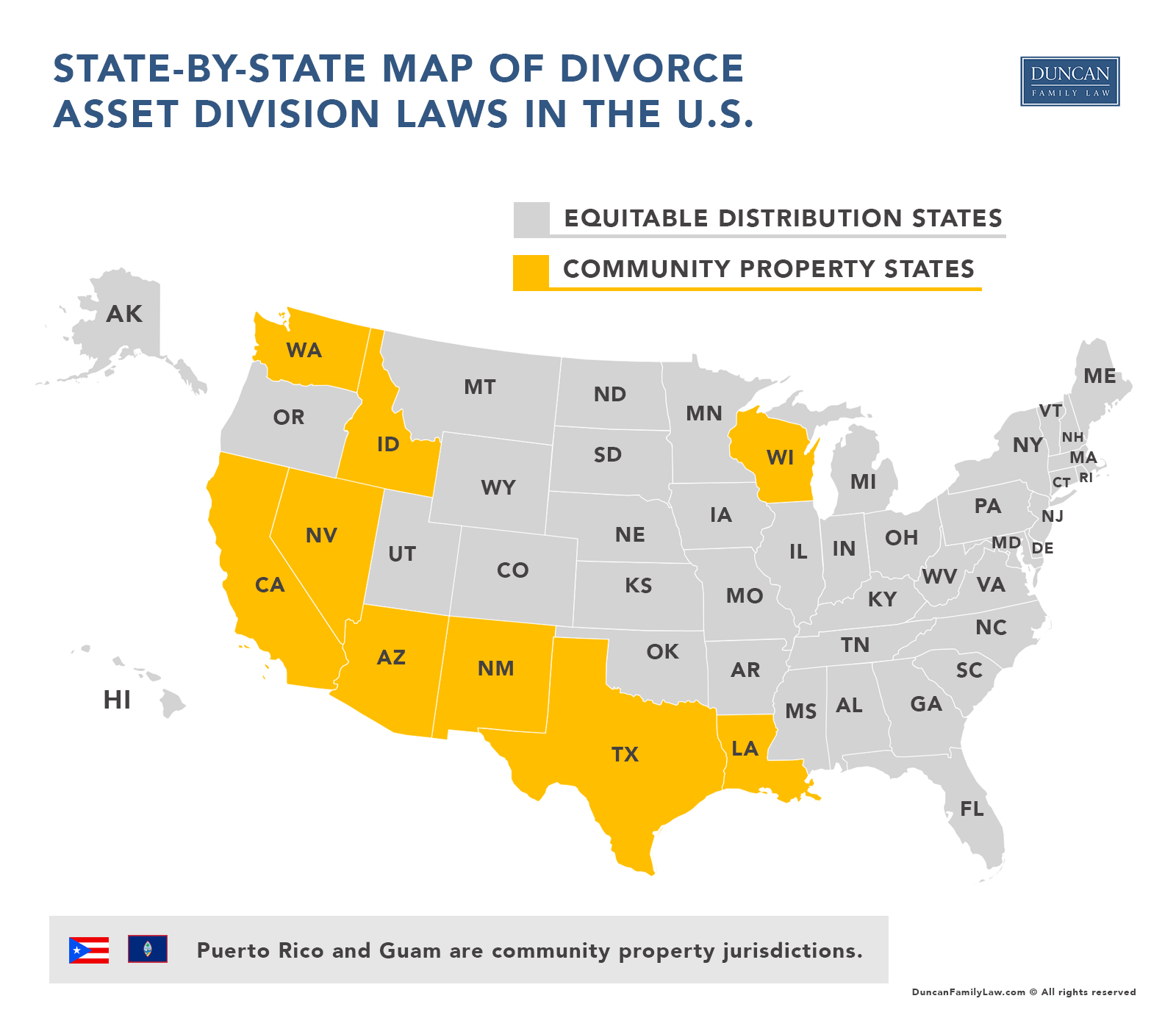

State-by-State Map of Divorce Asset Division Laws in the U.S

For detailed information on each state’s property division laws in divorce, you can visit Property Division Laws in Divorce: 50-State Survey .

Understanding Asset Division in Divorce

The division of assets, including house, in a divorce can be a complex and contentious process, often involving the challenge of dividing property between the couple, especially when dealing with debt settlement. State laws govern the regulations on property division in an uncontested divorce, making it crucial for couples to understand the differences between marital and separate property, as well as the distinctions between community property states and equitable distribution states. This understanding is essential for the final divorce judgment, especially when it comes to dividing assets like the house.

In a divorce, assets, including the house, and debts must be divided equitably by a judge, which may not necessarily be an equal 50/50 split. This process involves evaluating the value of marital assets, reaching a property settlement agreement, and final divorce judgment. It also includes an equal division of assets in an uncontested divorce. If a couple is unable to reach an agreement, the judge or court will make a decision during the divorce proceedings or with the help of legal representatives.

Marital vs. Separate Property

Marital property refers to any money or assets earned or acquired by either spouse during the course of the marriage, while separate property, including spouse’s separate property and personal property, is retained by the individual spouse and not subject to division during the judge divorce process. Understanding the distinction between separate and marital property is crucial, as property acquired before the marriage is typically considered separate property in the final divorce judgment. It’s important to understand this when presenting your case to the judge. Similarly, gifts or inheritances received during the marriage are also classified as separate property by the judge.

It is important for divorcing couples to accurately distinguish between marital and separate property, as this can significantly impact the division of assets. For example, a family home may be considered marital property if one spouse owned it before the marriage, but the other spouse’s contributions increased its value, and it can also be considered separate property in certain cases. In such situations, the tax consequences of dividing the family home must also be considered.

Community Property States vs. Equitable Distribution States

In the United States, there are two main systems for property division in divorce: community property states and equitable distribution states. Community property states require an equal division of marital assets, following community property rules, while equitable distribution states aim for a fair division based on various factors. That is why it is important for you to know your states divorce rules or to consult with a lawyer before taking any decision. (read more about California Divorce Rules)

Debt accumulated during the marriage is classified as marital property in community property states, and both spouses share the responsibility for repayment of such property and debt. On the other hand, equitable distribution states consider factors such as the duration of the marriage, each spouse’s contributions to marital property, and the earning capacity of each spouse when determining how assets and debts should be divided.

The Concept of Status-Only Divorce

Status-only divorce is a legal dissolution of marriage that does not include any provisions regarding assets or liabilities. This type of divorce is usually sought when one or both parties desire to remarry or quickly resolve the legal status of their marriage. While it may seem like an appealing option, it is essential to understand the process and potential consequences of a status-only divorce.

These consequences may include the inability to receive spousal support or division of assets, as well as potential tax implications. It is important to consider all of these factors before deciding to pursue a status-only divorce.

How Status-Only Divorce Works

To obtain a status-only divorce, the parties must submit a petition for divorce to the court and provide proof that the marriage is irretrievably broken. The court will then issue a divorce decree, which will terminate the marital status of the parties. In some cases, a qualified domestic relations order may be necessary to address the division of certain assets.

It is crucial to consult a divorce lawyer to determine if status-only divorce is an option in your state and navigate the complexities of the process.

Legal and Financial Consequences

Opting for a status-only divorce can result in unanticipated legal and financial ramifications. For example, the court will not distribute assets or liabilities, and the parties will remain accountable for any debts incurred during the marriage.

Additionally, the court may not consider matters such as alimony or child support. It is crucial to weigh the potential consequences of a status-only divorce before deciding if this option is right for you and your spouse.

Prenuptial and Postnuptial Agreements

Prenuptial and postnuptial agreements are contracts between spouses that outline the terms related to financial matters in the event of divorce, such as the allocation of property owned before marriage, division of assets or debt acquired during the marriage, and restrictions on spousal support. These agreements can provide clarity and potentially avoid disputes during divorce proceedings, making them an essential consideration for couples wishing to protect their individual assets.

By entering into a prenuptial or postnuptial agreement, couples can ensure a successful outcome.

Importance of Having an Agreement

Having a prenuptial or postnuptial agreement in place can offer numerous advantages, such as facilitating open communication about financial matters, protecting individual property and assets, and streamlining the divorce process by providing clarity and certainty about financial expectations and responsibilities.

Furthermore, these agreements can assist in preserving family wealth and ensuring inheritances for future generations. To draft a legally enforceable agreement, it is essential to consult a lawyer who is knowledgeable about the laws in your state. A legally binding agreement will ensure that the terms of the agreement are upheld in the event of divorce, regardless of any perceived imbalance.

Enforceability of Agreements

To avoid challenges during divorce proceedings, it is crucial to ensure that your prenuptial or postnuptial agreement, often referred to as a divorce agreement, meets all applicable legal requirements. Courts may scrutinize agreements for fairness and enforceability, so it is essential to work with a lawyer to draft an agreement that adheres to the laws of your state and protects your interests.

It is important to remember that prenuptial and postnuptial agreements are legally binding.

Strategies for Avoiding Asset Division in Divorce

In addition to prenuptial and postnuptial agreements, couples can explore alternative strategies for avoiding asset division in divorce. These may include mediation and collaborative divorce, which can help couples reach agreements on asset division without going to court, potentially saving time and money.

Mediation and collaborative divorce are both voluntary processes that involve the couple working with a neutral third party.

Mediation and Collaborative Divorce

Mediation and collaborative divorce are both forms of alternative dispute resolution for divorcing couples. In mediation, a neutral third party facilitates communication between the spouses to help them resolve issues such as property division, finances, and child custody.

Collaborative divorce, on the other hand, involves each spouse having their own attorney, with all parties cooperating to reach an agreement on asset division and other matters.

Both mediation and collaborative divorce can offer advantages and disadvantages. Mediation is typically more cost-effective and efficient, but it does not provide legal counsel for either party. Collaborative divorce allows for legal representation and a more cooperative process, but it can potentially become contentious and more expensive due to the involvement of multiple attorneys.

Creative Solutions for Asset Distribution

When traditional methods of asset division are not suitable, couples can also consider creative solutions for distributing assets. Examples of such solutions include trading assets, where one spouse agrees to give up their rights to certain assets in exchange for others, or a deferred sale of the marital home, where one spouse buys out the other’s share at a later date.

Another possible solution is establishing trusts for children, which involves placing assets in a trust for the benefit of the children of divorcing couples. This ensures that the children are financially supported after the divorce and that their needs are met, including education, healthcare, and other necessities.

Potential Risks and Challenges

Attempting to avoid asset division in divorce is not without potential risks and challenges. Couples should be aware of hidden assets, fraud, and tax implications that may arise when trying to navigate the complexities of asset division.

By being vigilant and seeking professional guidance, these risks can be mitigated and a fair outcome can be achieved.

Hidden Assets and Fraud

Hidden assets and fraud in divorce proceedings refer to the intentional concealment of assets or liabilities by one spouse. This can include hiding money, property, or other assets from the other spouse, potentially leading to legal disputes and financial consequences.

To avoid hidden assets or fraud, it is crucial for both spouses to disclose all assets and liabilities, including retirement accounts, during the divorce process. Reviewing financial documents, such as bank statements, tax returns, and credit reports, can help ensure that all assets and liabilities are disclosed. Additionally, hiring a financial advisor may be beneficial in identifying potential hidden assets or liabilities.

Tax Implications

Various asset division strategies can have tax implications that should be carefully considered before deciding on a course of action. For example, capital gains taxes, income taxes, and estate taxes may apply when dividing assets in a divorce.

To ensure you fully understand the tax implications of your asset division strategy, it is essential to consult with a tax professional. A tax expert can provide guidance on the potential tax consequences of different asset division strategies and help you avoid potential issues that may arise.

Seeking Professional Guidance

Navigating the complexities of asset division in divorce can be challenging, which is why it is crucial to seek professional guidance from experienced attorneys, financial advisors, and mediators. Our Property Division Lawyers at Duncan Family Law can help you understand your rights and obligations, as well as ensure that the asset division process is conducted fairly and equitably.

It is important to remember that asset division is a complex process and that it is important to have an asset division plan.

Finding the Right Professionals

Selecting the right professionals to assist with your divorce is essential for a successful outcome. When choosing an attorney, financial advisor, or mediator, consider their experience in asset division, their knowledge of the laws in your state, and their reputation for cooperation and positive outcomes.

Additionally, make sure to communicate openly and honestly with the professionals you choose. This will ensure that your interests are fully understood and that the professionals can provide the best possible guidance and support throughout the asset division process.

Importance of Communication and Cooperation

Maintaining open communication and cooperation with your spouse and the professionals involved in your divorce is critical for achieving a fair and mutually beneficial outcome. By being open and transparent about your needs, concerns, and perspectives, you can help ensure that your interests are taken into account during the asset division process.

Furthermore, cooperation between both parties and their professionals is essential for reaching mutually acceptable solutions. By working together and compromising when necessary, you can avoid lengthy and costly legal battles and achieve a more equitable division of assets.

Summary

Divorce without asset division may seem like an elusive goal, but with the right knowledge, strategies, and professional guidance, it can be achieved. Understanding the differences between marital and separate property, exploring alternative strategies such as status-only divorce, prenuptial and postnuptial agreements, mediation, and collaborative divorce, and being aware of potential risks and challenges, will help you navigate the complexities of asset division in divorce. Remember, open communication and cooperation are vital for a fair and mutually beneficial outcome.

Frequently Asked Questions

What assets are divisible at divorce?

Marital Property, such as real estate, rental properties, and 401K accounts, acquired after marriage is divisible at divorce.

Can you keep assets separate in marriage?

You can keep assets separate in marriage by keeping track of their premarital value and communicating with your partner about who owns and is responsible for what.

It’s recommended to also get legal documentation of any agreements.

Should we separate finances before divorce?

For a smooth divorce process, it is recommended to separate finances before commencing the procedure. This will protect both spouses from any unexpected costs and ensure no one has access to their partner’s assets.

Separating finances before the divorce process begins is a smart move. It can help to avoid any surprises or complications that may arise during the proceedings. Moreover, it ensures that it ensures that it is reliable.

Do you split everything after divorce?

Property and debts acquired during the marriage are usually divided evenly between the spouses, but each party will keep their own separate property and be responsible for their own separate debts.

Separate property may not be subject to division.

Can separate property be divided in a divorce?

Yes, separate property can be divided in a divorce. However, it is not subject to division in the same way that marital property is.